The evolving shopping behaviours of today’s consumers, especially in Asia, challenge traditional retail norms. Enter the ‘zero consumer’, a segment characterised by their omnichannel shopping habits, fluctuating brand loyalty, and a keen interest in health and sustainability. While prevalent in Asia, this trend is global, and businesses that overlook it risk obsolescence.

Unsplash

Understanding the Zero Consumer

McKinsey coined the term based on four characteristics of these consumers: zero boundaries, zero midrange, zero loyalty and net zero.

Consumers crave a seamless blend of physical and digital shopping. A McKinsey survey revealed a surge in omnichannel grocery shopping in South Korea (71%), India (78%), and China (74%), a stark contrast to figures from five years ago.

Zero consumers alternate between saving and splurging, challenging mid-tier brands. In China, 81% plan to cut back or opt for cheaper home goods, while 69% intend to indulge in experiences like dining and travel.

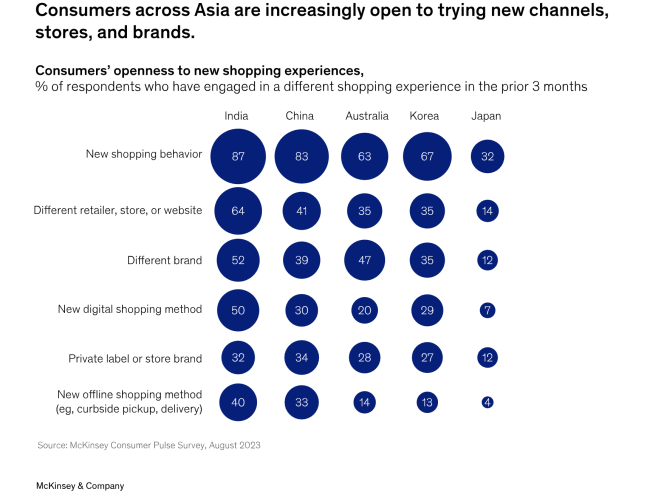

The pandemic-induced product shortages saw consumers exploring new brands. In a 2023 survey, 63% of Australians, 87% of Indians, 83% of Chinese, and 67% of South Koreans reported changing shopping behaviours in the past three months.

Consumers are increasingly drawn to sustainable products. However, the emphasis on sustainability varies across regions, with South Korea showing a higher willingness to pay for sustainable packaging.

The New Retail Landscape

Unsplash

Technological advancements, from AI to advanced analytics, empower retailers to offer personalised, omnichannel experiences. As technology reshapes the sector, retailers must invest in innovative solutions over merely rectifying past tech shortcomings.

Talent acquisition and retention have become more competitive, prompting companies to invest in upskilling and tapping into the gig economy. Additionally, the evolving competitive landscape, marked by declining in-store traffic and the rise of tech ecosystems, necessitates a re-evaluation of traditional retail strategies.

Strategies for Success

Understanding the zero consumer as well as the technological, talent, and competitive shifts in the industry is just the tip of the iceberg. McKinsey advocates four imperatives that forward-thinking companies need to adopt:

- Omnichannel Re-Invention: Leading retailers, like India’s Reliance partnering with Meta for WhatsApp grocery shopping, are blending online and offline experiences. Companies like Meituan in China build ecosystems of products, services, and consumer experiences, offering a plethora of services such as spa treatments, taxi services, and games.

- Refining Offerings: With zero consumers bypassing mid-tier products, retailers should bolster their essential and premium ranges. Private-label expansions, as seen with global grocers like Tesco, can offer affordable alternatives.

- Enhanced Personalisation: AI-driven personalization can foster deeper consumer relationships. Companies like Sephora use in-store AI tools for tailored product recommendations, emphasising the need for a cross-functional approach to personalization.

- Societal Impact: ESG-labelled products, such as ‘eco-friendly’ or ‘vegan’, have seen higher sales growth. Companies should align their actions with their ESG goals and communicate these initiatives effectively to consumers.

The emergence of the zero consumer presents both challenges and opportunities. It’s a call to innovate, pushing forward-thinking companies towards unparalleled growth. Companies that adapt will undoubtedly lead the next wave of retail evolution.